Understanding The 1031 Exchange

The Tax Code May Help You Own A Home In Tucson

A 1031 exchange is a type of real estate transaction that can defer any taxable gains. The key to a 1031 is an exchange is that the acquired new property must be “like-kind” property.

Tax-free exchanges of property are covered under Section 1031 of the Federal Tax Code.

The advantage of a 1031 exchange is that income taxes are not paid at the time of the exchange.

Section 1031 of the tax code creates property “classifications”.

The classification of a property determines if a property qualifies for a “1031 exchange”.

There are four classifications of Real Estate established by the Internal Revenue Service.

- Primarily held for sale. (Dealer Property)

- Held for personal use. (Personal Property)

- Held for investment. (Investment Property)

- Held for productive use in a trade or business. (Business Property)

Only classifications 3 & 4 qualify for a 1031 Exchange.

Property received and the property sold “or given” must be of “like-kind“. The use of the property determines its classification. Should the receiver of the property use it differently, it does not affect your tax status.

Like Kind Exchange Basics

To avoid any current taxable gain, you also must avoid receiving any “boot.” Boot means cash and/or property that is not like-kind property.

When mortgaged boot also includes the excess of the mortgage on the sold property.

If you receive any boot, you will incur a tax liability on any gain equal to the lesser of:

- The value of the boot or

- Your total gain on the transaction based on fair market values.

In the case where the boot is small, taxes will be small as well. On the other hand, if you receive lots of boot, you could have a big taxable gain.

To avoid receiving any boot, swap a less-valuable property for a more-valuable property. That way, you’ll be paying boot rather than receiving it.

Paying boot won’t trigger a taxable gain on your side of the deal.

The Key Is “Like Kind”

Remember “like kind” is based on your use of the property. Its grade or quality is not considered. Section 1031 treatment is not applied to property held outside the United States.

Vacation homes do not qualify for Section 1031 treatment if used solely for personal use. But may qualify if rented. It must pass a use test each year. Search Condos For Sale in Tucson AZ.

This information is provided as general background on the subject of Section 1031 exchanges. It does not cover all issues or rules on the subject. It is not a substitute for advice from your professional tax adviser. You should always consult your financial or tax adviser on such matters.

Like-Kind Exchange Tax Basics

The deferred gain in Section 1031 swap rolls over into the replacement property. It remains un-taxed until you sell that property in a taxable transaction.

Now should you die and still own a 1031 exchange property, the tax basis is “stepped up” to Fair Market Value. FMV is set as of the date of death — or as of six months later if your executor makes that choice.

This beneficial washes away most – or all – of the taxable gain on the replacement property.

If your heirs sell the property, they would only be taxed on gain that accrued after the magic date, if any. Nice!

Section 1031 rules and the step-up-on-death are why real estate helps make fortunes.

Selling An Existing 1031 Property?

Selling or “relinquishing” a 1031 property has some critical timelines to follow.

From the date of the sale of a 1031 property, the Exchangor has 45 days to identify replacements. Then a new timeline begins.

This time line runs for 135 days, assuming 45 days where required to identify new properties.

The time from the sale of an existing property to buying a new one can not exceed 180 days.

Should you want to identify or buy more than one property, you need to;

- Identify up to 3 properties of any value with the intent of buying at least one.

- You can identify more than 3 properties. But the aggregate value of the 3 must be less than 200% of the market value of the sold property.

- Should the value for the 3+ properties exceeds the 200%, you need to buy at least 95% of the value of the identified properties.

Time out!

If you are new to 1031 exchanges, take the time to discuss your interests with an expert. It may save you a lot of money.

Considering A Home in Tucson, AZ?

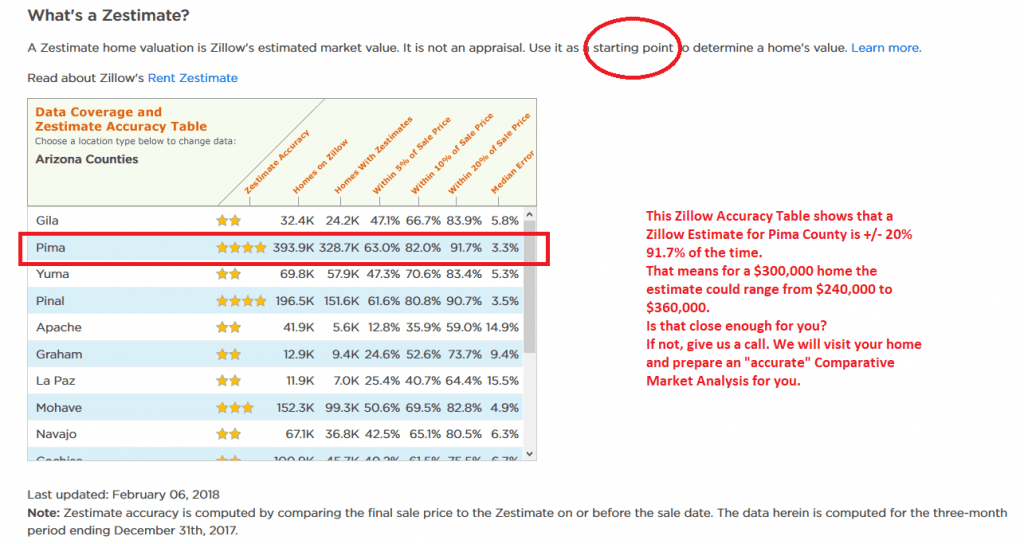

Are you thinking of buying a home in the greater Tucson area? Finding the right home can be a challenging process. But we can make the process much less stressful for you.

We have been Tucson Realtors since 2002. We know Tucson and the Tucson Real Estate market. As a top Realtor duo, we invest the time to understand your home buying interests and desires. At our first meeting, we will review the current real estate market with you. Show you the market data and then walk you through the Arizona home buying process.

Why? We want you to know what to expect. And what to plan for.

Interested in new construction? We’ll brief you on buying a new construction home. And what’s unique about the process.

For us, you are not another real estate transaction. You are a client and, future friend. We strive to create a relationship that continues long after you move into your home. Our goal is to provide insight, advice and the highest level of professional services to you. We want you to be proud to recommend us to your family, friends and acquaintances.

Review our profiles. Check out our backgrounds, education, and certifications.

We are here to help you “know what you need to know” to buy a home in Tucson, AZ. We provide you information on Tucson events, places to shop and restaurants. Our resources include contractors, electricians, and home services. We will also help you get deals on tile and paint to make the home you buy yours.

Best of all, our professional service backgrounds mean we put you first!

Conclusion

A 1031 exchange may be one way to buy a home in Tucson. But it is only for investment properties not primary homes. If you have 1031 investments you should also understand how a reverse 1031 exchange may be helpful.

Thank you for visiting www.premiertucsonhomes.com! It’s one of the top real estate websites in Tucson. Our clients tell us that.

Our website provides information on communities and neighborhoods in the greater Tucson area. Want more? Give us a call – 520-940-4541.

We are ready to answer your questions and help you get the information you are looking for.

We are a top Realtor team in Tucson, AZ since 2002. Take a few minutes to read our profiles and client testimonials.

Are we the Tucson Realtors you have been looking for?

Sign UP to receive daily HOME TRACKER UPDATES - OR - Our Monthly NEWSLETTER. And get regular updates on the Real Estate Market and events in Tucson, AZ.

Questions about the Tucson Real Estate Market or Tucson Homes for Sale? Call Us - 520 940 4541 OR complete the - CONTACT FORM - and we will get right back to you!

Back to – HOW TO BUY A HOUSE IN ARIZONA

Moving away is a big step and involves a lot of work that you must do. Of course, we all know that researching the home we will be buying is important. There are certain things to pay attention to that the

Moving away is a big step and involves a lot of work that you must do. Of course, we all know that researching the home we will be buying is important. There are certain things to pay attention to that the  When moving to a smaller and maybe more rural area, you may have trouble finding relevant information online. This goes for many small residential neighborhoods which are not connected to larger cities or towns.

When moving to a smaller and maybe more rural area, you may have trouble finding relevant information online. This goes for many small residential neighborhoods which are not connected to larger cities or towns. Walking up to a future neighbor’s home and knocking on the door is not always a good idea. It can come off as very intrusive. Also, it can make you very nervous. A more straightforward method, which feels more natural, is to go to a nearby park or community center.

Walking up to a future neighbor’s home and knocking on the door is not always a good idea. It can come off as very intrusive. Also, it can make you very nervous. A more straightforward method, which feels more natural, is to go to a nearby park or community center. If you are moving from a faraway area or state, you might want to ask the agent you hired to sell your current home to help you buy a new home.

If you are moving from a faraway area or state, you might want to ask the agent you hired to sell your current home to help you buy a new home.