Key Insights into the Real Estate Market in United States in 2024

From shifting demographics to technological advancements, several key factors are influencing the dynamics of the real estate market in 2024.

In this article, we delve into some of the most significant insights driving the real estate sector in the USA this year.

Mortgage Rates:

The United States real estate outlook for 2024 shows promise, but mortgage rates are the key. Lower mortgage rates will increase purchasing power and demand.

U.S. and Arizona new home builders are seeing the demand, but homes are getting smaller. The median home size is the lowest it has been since 2010.Coming in a bit over 2,100 square feet for single-family homes.

Decreased size and related costs are also leading buyers to townhouses. A trend most notable in larger urban areas. Lower costs, less maintenance means more freedom.

Demographic Shifts:

One of the primary drivers of change in the real estate market is demographic shifts. The millennial generation, now well into adulthood, is exerting a profound influence on housing preferences and buying patterns.

With many millennials reaching their peak home-buying years, there’s a growing demand for starter homes and urban living spaces that offer convenience and proximity to amenities.

Additionally, the aging baby boomer population is fueling demand for downsizing, retirement communities, and age-in-place accommodations, leading to the development of specialized housing options tailored to their needs.

Las Vegas real estate is poised for another year of robust growth in 2024, driven by an influx of remote workers seeking affordable housing options and a resurgence in tourism. Investors should keep an eye on emerging neighborhoods and diversify their portfolios to capitalize on this dynamic market.

Rise of Technology:

Technology continues to revolutionize the real estate industry, impacting everything from property searches to transaction processes.

Virtual reality (VR) and augmented reality (AR) tools are increasingly being used to provide immersive property tours, allowing prospective buyers to explore homes remotely with unprecedented detail and realism.

Furthermore, blockchain technology is gaining traction in property transactions, offering enhanced security, transparency, and efficiency in real estate deals.

Additionally, data analytics and artificial intelligence (AI) are empowering real estate professionals with valuable insights into market trends, pricing strategies, and investment opportunities.

Sustainability and ESG Considerations:

Environmental, social, and governance (ESG) considerations are playing an increasingly significant role in real estate decision-making.

Sustainable building practices, energy-efficient designs, and green certifications are becoming standard features in new developments as investors, developers, and tenants prioritize environmental responsibility and long-term sustainability.

Moreover, there’s a growing demand for properties that prioritize health and wellness, with features such as biophilic design elements, ample natural light, and access to green spaces gaining popularity among homebuyers and tenants alike.

Urban Revitalization and Suburban Resurgence:

The COVID-19 pandemic has prompted a reevaluation of urban living preferences, with many individuals and families seeking more space, privacy, and outdoor amenities in suburban and rural areas.

This trend has led to a resurgence of interest in suburban real estate markets, where home affordability, larger properties, and a slower pace of life are attracting buyers from urban centers.

However, even as suburbs gain popularity, many cities are undergoing revitalization efforts aimed at creating vibrant, walkable neighborhoods with mixed-use developments, cultural amenities, and enhanced public spaces to lure residents back to urban cores.

Remote Work and Flexible Living:

The widespread adoption of remote work arrangements has transformed how people view their living and working environments.

With the flexibility to work from anywhere, individuals are prioritizing housing options that offer a better quality of life, whether it’s a suburban home with a home office, a co-living space with built-in community and amenities, or a rural retreat with access to high-speed internet.

As remote work becomes a permanent fixture for many industries, the real estate market is witnessing a shift in demand towards properties that accommodate flexible living arrangements and remote work lifestyles.

Summary of United States Real Estate Market 2024:

The real estate landscape in the USA in 2024 is characterized by dynamic shifts in demographics, technological advancements, sustainability considerations, changing urban-suburban dynamics, and evolving work preferences.

To thrive in this rapidly evolving environment, stakeholders in the real estate industry must remain agile, innovative, and responsive to emerging trends and consumer preferences.

By embracing innovation, sustainability, and inclusivity, the real estate sector can navigate the challenges and seize the opportunities presented by the evolving needs and aspirations of today’s diverse population.

Above article in collaboration with https://frenchchateauforsale.co.uk/

Another Change Coming Soon for the United States Real Estate Market 2024

The Sitzer-Burnett litigation and verdict caused considerable uncertainty in an industry.

The verdict started a national conversation around real estate commissions. Both past and future. The National Association of REALTORS® proposed a settlement agreement to resolve the litigation.

Should the courts approve the settlement, the following change would occur.

NAR has agreed to put in place a new rule prohibiting offers of compensation on the MLS.

That change would go into effect in July 2024.

There will continue to be many ways in which buyer brokers could be compensated, including through offers of compensation communicated off MLS —as we have long believed that it is in the interests of the sellers, buyers, and their brokers to make offers of compensation —but using the MLS to communicate offers of compensation would no longer be an option.

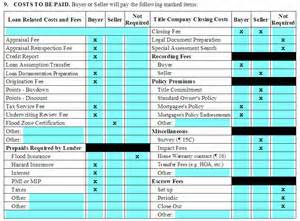

The types of compensation available for buyer brokers would continue to take multiple forms, depending on broker-consumer negotiations, including but not limited to:

- Fixed-fee commission paid directly by consumers.

- Concession from the seller.

- Portion of the listing broker’s compensation.

Compensation would continue to be negotiable and should always be negotiated between agents and the consumers they serve.

Conclusion

The United States Real Estate Market 2024 will continue to experience the ups, downs and sideway movements of any market.

Will the outlook come true? Only, time will tell!

Thank you for visiting www.premiertucsonhomes.com! It’s one of the top real estate websites in Tucson. Our clients tell us that.

Our website provides information on communities and neighborhoods in the greater Tucson area. Want more? Give us a call – 520-940-4541.

We are ready to answer your questions and help you get the information you are looking for.

We are a top Realtor team in Tucson, AZ since 2002. Take a few minutes to read our profiles and client testimonials.

Are we the Tucson Realtors you have been looking for?

Sign UP to receive daily HOME TRACKER UPDATES - OR - Our Monthly NEWSLETTER. And get regular updates on the Real Estate Market and events in Tucson, AZ.

Questions about the Tucson Real Estate Market or Tucson Homes for Sale? Call Us - 520 940 4541 OR complete the - CONTACT FORM - and we will get right back to you!